http://klse.i3investor.com/blogs/koonyewyinblog/

Why most of us cannot become super investors? - Koon Yew Yin

Author: Koon Yew Yin |

Publish date: Thu, 6 Feb 13:17

The last time I published ‘

How to become a super investor?’ I received more than 200 commentaries. Of course, most of the commentaries are good, but a few are really bad and insulting. In fact, one doubted my sincerity and accused me of trying to promote Jaya Tiasa. Fortunately or unfortunately, Jaya Tiasa did go up by about 20%, soon after the publication of my article. It went up too fast and not sustainable. As expected, it is making a healthy correction.

In view of this situation, I am obliged to write this article and also I genuinely wish to share my knowledge with people who are interested in share investment.

For a long time, I have been trying to teach my wife, close relatives and friends to follow what I did but all of them could not emulate my performance or achievement. I think the reason is that to be a super investor your brain has to be wired differently when you are young. It is a nature built into your brain which cannot be nurtured. By the time you are an adult, either you have it or you don’t have it.

For a start, let me define what is a super investor? To qualify as a super investor, you must have a long term track record of making more than 20% per year. Warren Buffet has been able to achieve about 22% per year over the last 20 or more years. Using the empirical formula of 72; when 72 is divided by the rate of return the answer is the number of years for you to double your capital. In Warren’s case, he can double his capital in 72 divided by 22 = 3.3 years. That means $1 will become $2 in 3.3 years and $2 will become $4 in 6.6 years and $4 will become $8 in 9.9 years. At 22% return pa, Warren can turn $1 to $8 in about 10 years.

How many of us can achieve more than 20% return per year in the last 10 or more years?

To test the putting is in the eating. In retrospective, did you make a huge amount during the Y2K computer crisis when MPI and Unisem went above Rm 40 per share? Globtronics went up from about Rm 2.00 to above Rm 20.00 in about 18 months.

Did you make much money when CPO went above Rm 4,000 per ton a few years ago?

Did you make a killing when all the rubber glove shares shot through the roof due to the HINI fear about 3 or 4 years ago? Supermax went up from Rm 1.00 to Rm 6.50 in 18 months.

Did you buy SOP when it was selling about Rm 2.50 about 3 years ago? SOP went above Rm 6.50 per share recently.

If you did not make much money when the above mentioned opportunities came, you can only be a mediocre investor and you have no hope to be a super investor.

Looking forward, do you dare to buy Jaya Tiasa when it is not showing much profit currently and the share price has been depressed for quite a long time? Most fund managers are not interested to own Jaya Tiasa. Can you see that it is really undervalued and it has tremendous profit growth prospect?

About 3 years ago, Sarawak Oil Palm (SOP) was selling about Rm 2.50 per share because most of their oil palms were young. As a result, the company was not showing much profit. For the same reason, Jaya Tiasa is now showing poor profit. Most of the Fund Managers do not want to own it. But, do you have the patience to own it and wait for a few years to maximize your profit? I am obliged to tell you that Jaya Tiasa is my major investment holdings.

I can tell you that very few of you can achieve above 20% return per year over a long period of time and if you spend enough time studying investors like Charlie Munger, Warren Buffett and other famous investors, you will understand what I mean.

I know that everyone reading this article is exceedingly intelligent and you have all worked hard to get where you are. You are smart and experienced. And yet, there is little likelihood of anyone here becoming a great investor. You all have a lot of advantages over normal ordinary investors, and yet you have almost no chance of standing out from the crowd over a long period of time.

The reason is that it does not much matter what your IQ is, or how many books or magazines or newspapers you have read, or how much experience you have, or will have later in your career. These are things that many people have and yet very few can end up compounding at 20% or more over their careers.

I know this is a controversial thing to say and I do not want to offend anyone. On the bright side, although most of you will not be able to compound money at 20% for your entire career, a lot of you will turn out to be good, above average investors because you can learn to be an above-average investor. You can learn to do well enough, if you are smart and hard working. You can make millions without being a great investor. You can learn to outperform the averages by a couple points a year through hard work and an above- average IQ and a lot of study. So there is no reason to be discouraged by what I am saying today. You can have a really successful, lucrative career even if you are not the next Warren Buffett.

Going to the best business schools and reading every book or article ever written on investing would not make you a super investor. Neither will years of experience. If book knowledge and long experience will make you a multi- millionaire, then all the Professors in finance, all the old fund managers and old people who have been investing for decades, would be multi-millionaires.

So what are the sources of competitive advantage for an investor? They have to do with psychology, and psychology is hard wired into your brain. It is a part of you. You cannot do much to change it even if you read a lot of books on the subject.

After having said all these discouraging words, I think some of you who can master the following traits or qualities will have a better chance to become a successful investor.

Trait 1. The ability to buy stocks while others are panicking and sell stocks while others are euphoric. In 1983 when China wanted to take back Hong Kong, the stock market crashed. Did you dare to buy Hong Kong shares knowing the risk when the communists took over the control Hong Kong?

Everyone thinks they can do this, but then when the market crashed on October 19, 1987, almost no one had the stomach to buy. When the year 1999 came around and the market was going up almost every day, you could not bring yourself to sell because if you did, you might fall behind your peers.

Trait 2. A great investor is one who is obsessive about playing the game and wanting to win. These people do not just enjoy investing; they live it. They wake up in the morning and the first thing they think about, while they are still half asleep, is a stock they have been researching, or one of the stocks they are thinking about selling, or what the greatest risk to their portfolio is and how they are going to neutralize that risk.

Trait 3. A good investor is the willingness to learn from past mistakes or to admit that he or she has bought the wrong share. It is so hard for people to recognize their own mistakes and sell the bad share which they bought at a higher price. Most people would much rather just move on and ignore the dumb things they have done in the past. But if you ignore mistakes without fully analyzing them, you will undoubtedly make a similar mistake later in your career. In fact, even if you do analyze them it is not easy to avoid repeating the same mistakes.

Trait 4. A fourth trait is an inherent sense of risk based on common sense. You must have the common sense to realize the risk of buying any share which has gone up a lot and when all the analysts are recommending buy. No share can go up indefinitely for whatever reason. Quite often you might be tempted to fall in love with your purchase because it has been going up and up. You are so proud of your pick and refuse to sell it. Remember your ego can skew your judgment.

Trait 5: Great investors have confidence in their own convictions and stick with them, even when facing criticism. Buffett never get into the dot-com mania and he was being criticized publicly for ignoring technology stocks. Eventually he was proven right. Unlike Buffet, we small investors can get in and out quickly and make some profit.

Besides confidence, you must have patience to wait to buy when it is has established a base and not buy when it has shot up due to some exciting hot news.

Trait 6. It is the ability to think clearly. There are a lot of people who have genius IQs who cannot think clearly, though they can figure out bond or option pricing in their heads. I have met a lot of smart people in my life time but very few of them can come up with an inventive way of looking at a problem.

As you know, there are so many criteria to consider in share selection and invariably all the professionals will consider the current profit is most important. They do not look at the future profit growth prospect of the share. They do not look at the company and the industry like a business man or an entrepreneur.

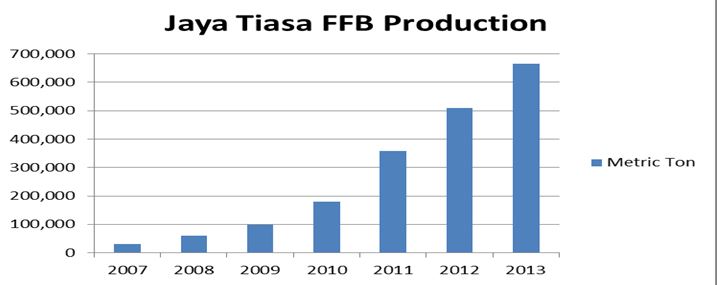

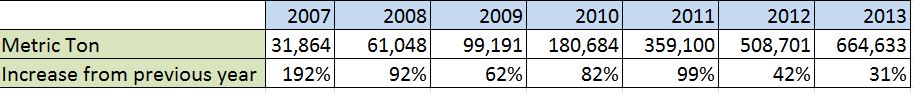

Again I have to use Jaya Tiasa as an example to explain this important point of making super return. You only have to have the elementary knowledge of arithmetic to calculate that JT will almost double its fresh fruits bunches (FFB) production in 3 years. Even if the CPO price remains unchanged, its profit from its oil palm plantation will surely double.

Moreover, JT has about 2,500 sq km of forest to supply all the raw material for its plywood and timber business. Surely any one with eyes should be able to see the huge forest ( 50 km X 50 km approximately) which is the competitive advantage it has over all the manufacturers in China, Taiwan, Japan, India and in any other countries. Yet all the professional fund managers cannot see the forest as the competitive advantage JT has over other competitors.

As Warren Buffet often say that in the competitive world of doing business, all your competitors are constantly trying to attack you and you must build a moat around you to protect yourself. Unfortunately, in the Malaysian stock market, we do not have stocks like Coco Cola, Gillett Razors or Mac Donald which have the market competitive advantage.

Trait 7. Finally the most important, and rarest, trait of all is the ability to live through volatility without changing your investment thought process. This is almost impossible for most people to do; when the chips are down they have a terrible time not getting themselves to average down or to put any money into stocks at all when the market is going down. People do not like short- term pain even if it would result in better long-term results. Very few investors can handle the volatility required for high portfolio returns. They equate short-term volatility with risk. This is irrational; risk means that if you are wrong about a bet you make, you lose money. A swing up or down over a relatively short time period is not a loss and therefore not risk, unless you are prone to panicking at the bottom and locking in the loss. But most people just cannot see it that way; their brains would not let them. Their panic instinct steps in and shuts down the normal brain function.

Conclusion: I must realize the risk I am taking in writing this article. People will judge me and they will laugh at me if I am wrong in betting Jaya Tiasa so heavily. I still have some SOP which I have bought when it was cheaper and I sold a large portion to buy JT. I also have Mudajaya, Kulim, and smaller amount of Symphony Life, Success Transformer.

Only time will tell whether I am right or wrong. Nevertheless, my intention is honorable and altruistic. I also believe I have some special knowledge which will help you make more money from the stock market.